1. Overview of China composites industry

1.1 Overview of China fiberglass sub-sector

(1) The output of fiberglass:

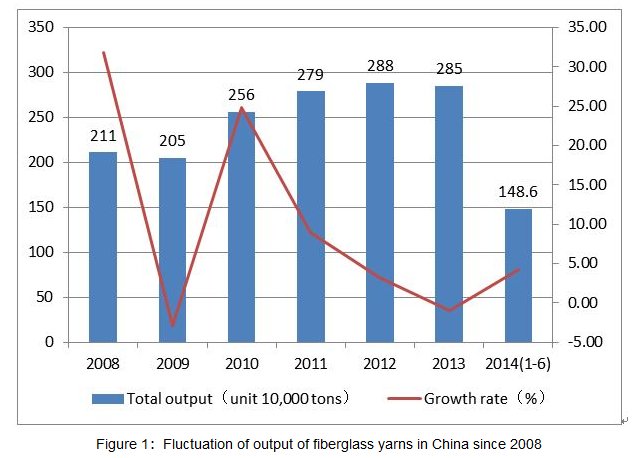

In 2013, the output of fiberglass yarns decreased by 1.0 percent to reach 2.85 million tons. In the first half of 2014, the output of fiberglass yarns grew by 4.3 percent to reach 1.49 million tons. (Remarks: not including Taiwan, the same below)

Since the financial crisis, the growth rate of fiberglass yarns production showed double “V” type change. In the first stage (from 2008 to 2010), the growth rate had a rapid decline and recovery. In the second stage (from 2010 to 2014), the fiberglass market has been in the doldrums. At the same time, the production cost of Chinese enterprises has been growing rapidly. It is more and more difficult to maintain the rapid expansion of production capacity and the low price competition. Chinese fiberglass yarn producers have actively adjusted the development mode, reducing the new production capacity, and pay more attention to the innovation and management. So the growth rate of fiberglass yarns production has become very slow.

From the beginning of 2014, the strong recovery in the wind energy, transportation, and thermal plastic, brings to the strong demand for fiberglass yarns. And now most kinds of fiberglass yarns prices have rebounded.

(2) The consumption of fiberglass:

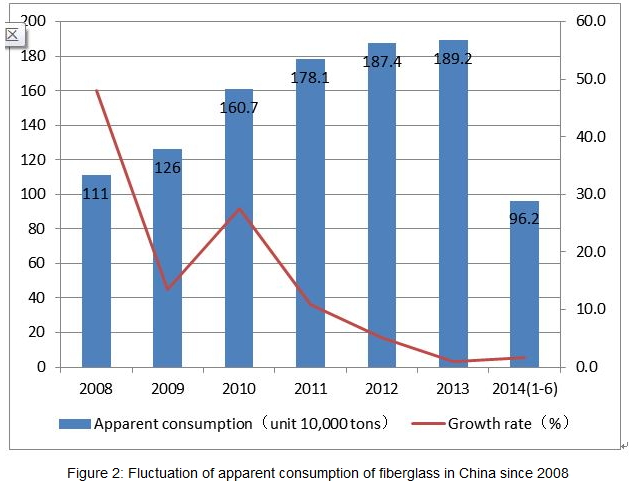

In 2013, the export volume of fiberglass (including fiberglass yarns and fiberglass products) decreased by 1.6 percent to reach 1.19 million tons. At the same time, the import volume of fiberglass grew by 14.5 percent to reach 233 thousand tons. In the first half of 2014, the import volume grew by 8.6 percent to reach 123 thousand tons.

In 2013, the output and the export volume decreased, and the import volume grew. Based on that, the apparent consumption of fiberglass in China reached 1.89 million tons, the same level as the previous year. This means that the development of China FRP sector is in transition, and the demand for high quality fiberglass is growing rapidly.

1.2 Overview of China carbon fiber sub-sector

(1) The output of carbon fiber:

In 2013, the output of carbon fiber only reached 2650 tons. By the end of 2013, there were more than 30 carbon fiber producers in China, and the total capacity of carbon fiber had reached 14000 tons. But the capacity utilization is very low.

Now the Chinese government attaches great importance to the development of carbon fiber, and has formulated a lot of support policy. Now Chinese companies can produce a stable T300-grade carbon fiber, and also have mastered the key technologies of T700-grade, T800-grade carbon fiber production.

(2) The consumption of carbon fiber:

In 2013, the import volume of carbon fiber (including carbon fiber yarn and carbon fiber products) reached 12386 tons. The export volume of carbon fiber reached 941 tons. Based on that, the apparent consumption of carbon fiber in China reached about 15000 tons.

1.3 Overview of China fiber reinforced plastics (FRP) sub-sector

(1) The output of FRP:

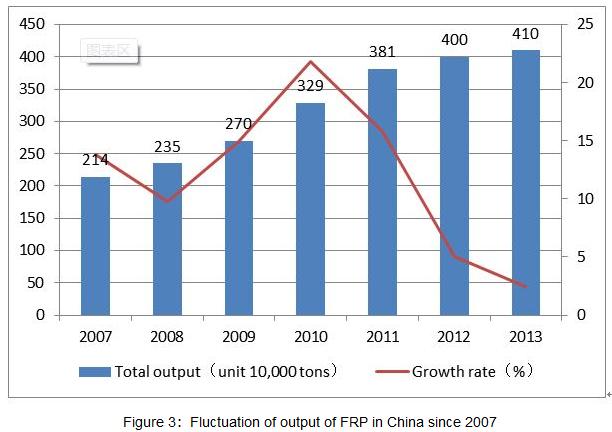

In 2013, the output of FRP grew by 2.5 percent to reach 4.1 million tons. The growth rate of FRP output reached a peak in 2010. But between 2011 and 2013, the development of many applications was in the bottom, reducing the demand for FRP. At the same time, the FRP sector met with a lot of problems, such as rising of raw material prices, lack of labor, quality defects, and expansion of market. So the growth rate of FRP output keep in a low speed now. And the development of FRP sector is in transition.

(2) Performance Itemized by Procedures:

Winding Products: In 2013, the output of winding products reached about 730 thousand tons, the same level as the previous year. In recent years, the demand for winding products was relatively stable. Among them, pipes for drainage works decreased, tanks for chemical and brewing basically unchanged, and products for environmental protection and ocean engineering increased.

SMC/BMC Products: In 2013, the output of SMC/BMC products decreased by 4 percent to reach 370 thousand tons. The products are mainly used in automotive, electrical equipment, construction, and so on. The reasons of demand reduction included the downturn of estate, the deceleration of automotive. But the demand in public facilities is growing.

Pultrusion Products: In 2013, the output of pultrusion products grew by 8 percent to reach 280 thousand tons. Because of lightweight and high-strength, the demand in construction and power equipment is growing rapidly.

Continuous Molding Products: In 2013, the output of continuous molding products grew by 10 percent to reach 140 thousand tons. Due to the higher prices of energy, energy-saving workshop is popularizing steadily, so the output of lighting board is growing rapidly. Except that, the output of box board for lightweight transporter also is growing.

Liquid Composite Molding Products (LCM): The LCM technology has many advantages, such as low-cost, flexible production, ability to produce large products, internal reinforcement, one-shot molding and so on. In addition to the growth of wind turbine blades, the quantity of LCM products used in ships, railcars is growing rapidly.

(3) The development of fiber reinforced thermoplastic plastics (FRTP)

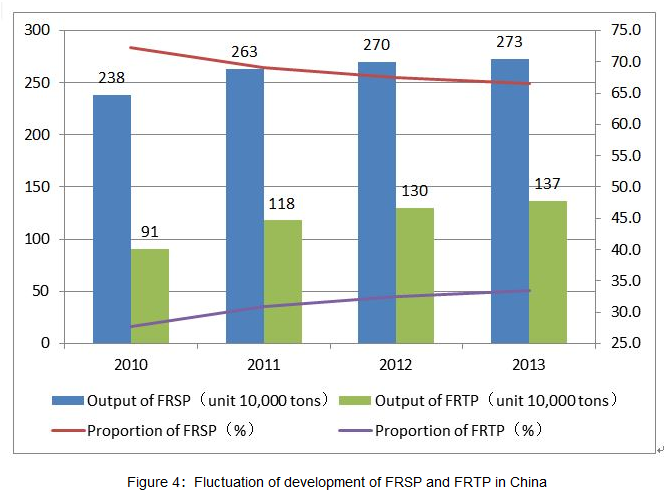

In 2013, the output of FRSP grew by 1 percent to reach 2.73 million tons, and the output of FRTP grew by 5 percent to reach 1.37 million tons. In the recent years, the growth of FRTP output is always faster than FRSP. And now the proportion of FRTP has reached 33.4 percent.

For example, Chinese producers of fiberglass are investing more in research and production of fiberglass for FRTP. The production lines of LFT-D and CFRTP have been successfully developed in China. And in terms of application, FRTP products have been used not only in automotive and electrical equipment, but also in construction, aquaculture, wind power, shipbuilding, medical device, sports, and so on.

---the news is from "China Composite Expo 2021"

Post time: May-07-2021